Investors in Nigeria’s capital market will benefit from a N150m annual exemption under the new Capital Gains Tax regime, following a high-level stakeholder dialogue convened by the Nigerian Exchange Group on the Tax Reform Act 2024.

Investors in Nigeria’s capital market will benefit from a N150m annual exemption under the new Capital Gains Tax regime, following a high-level stakeholder dialogue convened by the Nigerian Exchange Group on the Tax Reform Act 2024.

The provision, which takes effect from January 2026, is designed to protect 99.9 per cent of retail investors from the 30 per cent tax on gains from the disposal of shares.

The exemption was clarified by the Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Taiwo Oyedele, during the forum, which brought together issuers, investors, intermediaries, and regulators.

Oyedele explained that while the standard rate is 30 per cent, a reduced 25 per cent CGT will apply where proceeds from share sales are reinvested in fixed income or other non-equity assets. He added that reinvestments into Nigerian companies, whether listed or unlisted, will remain fully exempt to encourage capital inflows into productive sectors of the economy.

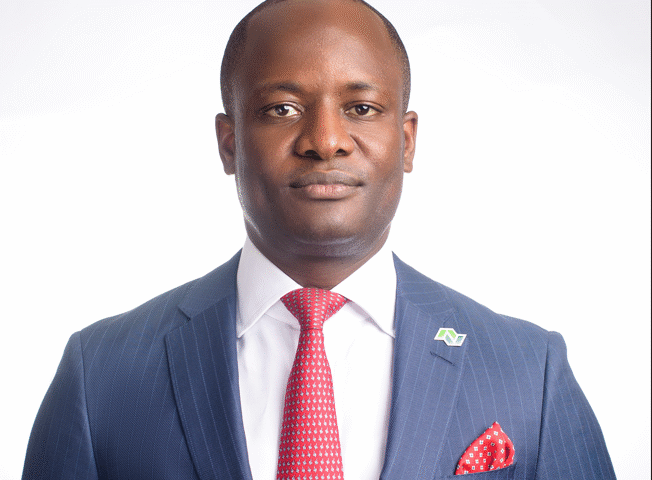

Speaking at the session, Temi Popoola, GMD/Chief Executive Officer of NGX Group, said the dialogue was necessary to ensure clarity for issuers and investors ahead of the implementation. “Reforms of this scale raise important questions for the market. Our priority is to keep the capital market attractive and forward-looking while supporting long-term growth,” he noted.

Also, the Chairman of NGX Group, Umaru Kwairanga, stressed the role of NGX as a trusted convener, ensuring that stakeholders are well-informed and market confidence preserved. He added that engaging with regulators on such critical reforms helps sustain Nigeria’s market competitiveness compared with other African economies.

“At NGX Group, we believe that significant policy shifts must be clearly understood and calibrated to preserve market confidence. Our core function is to facilitate this essential engagement between policymakers and the market to ensure reforms translate into sustainable, long-term economic growth.”

The dialogue also addressed concerns around the determination of base cost, prospective calculations from the Act’s commencement date, and the treatment of cross-listed securities to avoid double taxation.