Non-interest capital market hits N1.6tn, says SEC

The Securities and Exchange Commission has said Nigeria’s non-interest capital market has grown to over N1.6tn, reflecting investor confidence and participation in finance.

The Securities and Exchange Commission has said Nigeria’s non-interest capital market has grown to over N1.6tn, reflecting investor confidence and participation in finance.

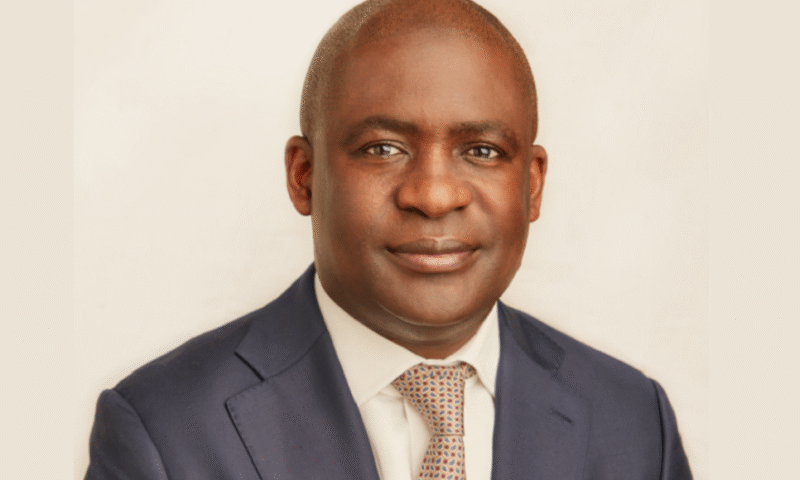

The Director-General of the SEC, Emomotimi Agama, disclosed this on Monday at a joint press briefing in Abuja ahead of the 7th African International Conference on Islamic Finance, scheduled to be held in Lagos on November 4 and 5, 2025.’

The conference, jointly organised by the SEC, Metropolitan Law Firm, and Metropolitan Skills Ltd., is themed ‘Africa Emerging: A Prosperous and Inclusive Outlook.’ It aims to promote ethical financing as a tool for building a resilient and inclusive African economy.

Agama said the non-interest capital market had recorded remarkable momentum, with Sukuk dominating the sector, noting that the most recent Sukuk issuance was oversubscribed by over 700 per cent, demonstrating strong investor appetite for non-interest products and confidence in the regulatory environment.

“The non-interest capital market has attained a valuation of N1.6tn. The overwhelming subscription to our Sukuk issuances demonstrates strong investor confidence and an expanding demand for ethical financial instruments,” he said.

He added that the enactment of the Investments and Securities Act 2025 had strengthened the legal foundation for non-interest financial products, empowering the SEC to register non-interest collective investment schemes and broaden investment options for Nigerians.

According to him, the upcoming African International Conference on Islamic Finance will feature high-level discussions on unlocking capital for infrastructure, green and ethical investments, agricultural financing, and the role of fintech in advancing Islamic finance across the continent.

Agama said the conference was strategically positioned to coincide with the conclusion of the Revised Nigerian Capital Market Masterplan (2021–2025), adding that it would help chart the next phase of sustainable financial development in Africa.

Also speaking, the Managing Partner of Metropolitan Law Firm and Chairman of the AICIF 2025 Planning Committee, Ummahani Amin, said the event had become one of the most important gatherings for policymakers, regulators, and investors advancing ethical and sustainable finance in Africa.

She added that the partnership with the SEC underscored a shared vision to strengthen the Islamic finance ecosystem, deepen investor confidence, and support innovation that aligns with integrity and shared prosperity.

The Peoples Democratic Party, PDP, in Kaduna State has suspended its State Secretary, Sa’idu Adamu, over alleged gross misconduct and anti-party activities.

The Peoples Democratic Party, PDP, in Kaduna State has suspended its State Secretary, Sa’idu Adamu, over alleged gross misconduct and anti-party activities.

Governor Ahmadu Fintiri of Adamawa State has assured members of the Peoples Democratic Party (PDP) that the upcoming 2025 national convention will be open, fair, and transparent.

Governor Ahmadu Fintiri of Adamawa State has assured members of the Peoples Democratic Party (PDP) that the upcoming 2025 national convention will be open, fair, and transparent.

Human rights lawyer, Inibehe Effiong, has urged the Nigeria police to probe the Minister of Science, Technology, and Innovation, Uche Nnaji, over allegations of certificate forgery.

Human rights lawyer, Inibehe Effiong, has urged the Nigeria police to probe the Minister of Science, Technology, and Innovation, Uche Nnaji, over allegations of certificate forgery.

The Chief of Staff to the President, Femi Gbajabiamila, on Monday, facilitated free medical outreach at Agboyi Ori Omi, a remote riverine community in the Agboyi-Ketu Local Council Development Area of Lagos State.

The Chief of Staff to the President, Femi Gbajabiamila, on Monday, facilitated free medical outreach at Agboyi Ori Omi, a remote riverine community in the Agboyi-Ketu Local Council Development Area of Lagos State.

Omoluabi Progressives, a group loyal to former Minister of Interior, Rauf Aregbesola, has accused the Federal Government of unlawfully releasing local government allocations in Osun State to what it described as “illegal” council chairmen loyal to the All Progressives Congress.

Omoluabi Progressives, a group loyal to former Minister of Interior, Rauf Aregbesola, has accused the Federal Government of unlawfully releasing local government allocations in Osun State to what it described as “illegal” council chairmen loyal to the All Progressives Congress.

Nigerians spent about N242.68bn on the importation of solar panels in the first half of 2025, underscoring the country’s sustained demand for renewable energy solutions even as the Federal Government intensifies efforts to boost local production.

Nigerians spent about N242.68bn on the importation of solar panels in the first half of 2025, underscoring the country’s sustained demand for renewable energy solutions even as the Federal Government intensifies efforts to boost local production.

President Bola Tinubu has approved a N4tn bond to clear verified debts owed to power generation companies and gas suppliers as part of efforts to stabilise Nigeria’s electricity market and restore confidence in the sector.

President Bola Tinubu has approved a N4tn bond to clear verified debts owed to power generation companies and gas suppliers as part of efforts to stabilise Nigeria’s electricity market and restore confidence in the sector.

Ecobank Nigeria has announced the launch of its upgraded mobile app targeted at delivering a faster, smarter, and simpler banking experience for its customers.

Ecobank Nigeria has announced the launch of its upgraded mobile app targeted at delivering a faster, smarter, and simpler banking experience for its customers.