Transnational Corporation Plc (“Transcorp Group”), Africa’s leading listed conglomerate, has announced its

unaudited Q3 2025 financial results, delivering strong growth across business

lines.

The Group recorded a 39% year-on-year increase in revenue, rising from

₦297.7 billion in Q3 2024 to ₦413.4 billion in Q3 2025.

Profit Before Tax (PBT) grew by 18%, closing at ₦124.5 billion, compared to ₦105.5 billion in the same period last year.

Transcorp Group maintained its strong growth trajectory, driven by the Company’s resilient business strategy and operational excellence.

Transcorp Group delivered a revenue of ₦413.4 billion, representing a

39% rise from ₦297.7 billion in Q3 2024.

All operating units recorded significant growth, with the increased

power generation capacity at the Group’s power plants and expansion in the hospitality revenue stream with the inclusion of the 5,000-capacity

Transcorp Centre Abuja.

Sustained Profitability. Profit Before Tax rose by 18% to ₦124.5 billion, up from ₦105.5 billion in Q3 2024.

Profit After Tax increased by 20.5%, reaching ₦91.4 billion, compared to

₦75.9 billion in 2024.

The Group maintained a gross profit margin of 48%, reflecting disciplined

cost management and strategic pricing across its business units,

underpinned by a strong ethos of operational efficiency.

Chairman Transnational Corporation Plc, Tony O. Elumelu, CFR, commented;

“Transcorp’s robust revenue and earnings delivery demonstrates the opportunity in the Nigerian economy. Our diversified portfolio continues to

offer investors access to key drivers of Nigeria’s growth opportunity. As the macro-economic climate improves, the Group is well-positioned to take advantage of Nigeria’s extraordinary potential. We are executing our impact-

driven mandate through strategic investments that solidify our leadership in

Nigeria’s vital sectors. Our diversified model continues to demonstrate

resilience, generating significant value.

In power generation and distribution, we are closing the energy deficit in Nigeria, propelling national development. We increased our power

generation capacity at all our plants, and we remain committed to power Nigerians out of poverty. In hospitality, we are redefining excellence, with the

landmark Transcorp Centre Abuja setting a new standard for world-class events. We remain unrelenting in our commitment to delivering superior

shareholder returns and driving the long-term transformation of Nigeria’s economy.”

Commenting on the results, President/Group CEO of Transcorp Plc, Dr. Owen

Omogiafo, OON, stated:

“Transcorp Group’s Q3 2025 results demonstrate the successful execution of

our strategic direction, operational excellence and portfolio-wide efficiency.

Driven by our core purpose to “Improve Lives and Transform Africa”, we

continue to optimise our businesses to deliver superior stakeholder value.

As Nigeria’s leading conglomerate, with a disciplined approach to excellent

corporate strategy, we are positioned to finish the year with strength and

strategic momentum. We offer investors unique access to the Nigerian

economy, delivering sustainable returns for our shareholders and championing

economic growth.”

Transnational Corporation Plc is one of Africa’s leading,

listed conglomerates, with strategic investments in the power, hospitality, and

energy sectors, driven by its mission to improve lives and transform Africa.

Transcorp’s power businesses, Transcorp Power Plc and Transafam Power,

provide over 20% of Nigeria’s installed power capacity. Transcorp is

committed to developing Nigeria’s domestic energy value chain through its

investments in OPL281. The Group’s hospitality business, Transcorp Hotels Plc,

owns the iconic Transcorp Hilton Abuja, Nigeria’s flagship hospitality

destination and Nigeria’s largest event venue, the Transcorp Centre Abuja.

Human rights activist and public commentator, Mahdi Shehu, has warned that the ruling All Progressives Congress (APC) may soon face the same downfall that befell the Peoples Democratic Party (PDP), saying power built on arrogance and injustice cannot last forever.

Human rights activist and public commentator, Mahdi Shehu, has warned that the ruling All Progressives Congress (APC) may soon face the same downfall that befell the Peoples Democratic Party (PDP), saying power built on arrogance and injustice cannot last forever.

The Independent National Electoral Commission, INEC, has extended the ongoing collection of the Permanent Voter Card, PVC, in Anambra State to November 2, to enable eligible voters collect their cards.

The Independent National Electoral Commission, INEC, has extended the ongoing collection of the Permanent Voter Card, PVC, in Anambra State to November 2, to enable eligible voters collect their cards.

The Jigawa State Police Command has presented 59 cheques amounting to the sum of N31,450,025.16k to families of fallen police officers.

The Jigawa State Police Command has presented 59 cheques amounting to the sum of N31,450,025.16k to families of fallen police officers.

Nigeria’s capital market regulator, the Securities and Exchange Commission, has raised concerns over the growing preference of Nigerians for cryptocurrency trading over investments in the traditional capital market.

Nigeria’s capital market regulator, the Securities and Exchange Commission, has raised concerns over the growing preference of Nigerians for cryptocurrency trading over investments in the traditional capital market.

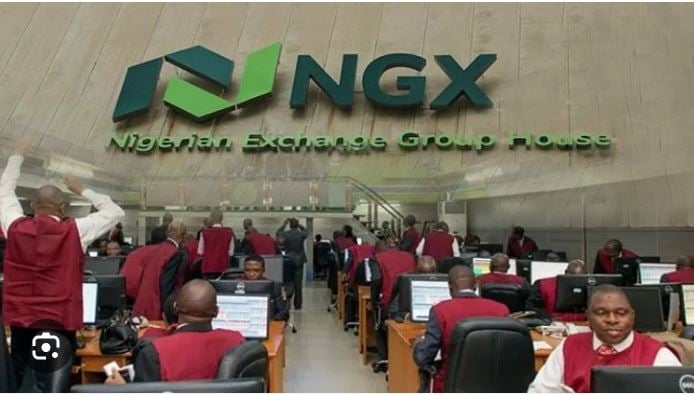

The Nigerian equities market opened the week on a bearish note as investors embarked on profit-taking in some high-cap stocks, leading to a loss of N94bn in market capitalisation at the close of trading on Monday.

The Nigerian equities market opened the week on a bearish note as investors embarked on profit-taking in some high-cap stocks, leading to a loss of N94bn in market capitalisation at the close of trading on Monday.