The Independent National Electoral Commission (INEC) has registered two new political parties.

The Independent National Electoral Commission (INEC) has registered two new political parties.

The registration brings the total number of registered political parties in Nigeria to 21. The Commission warned that persistent internal leadership crises within parties pose a serious threat to democratic consolidation as preparations for the 2027 General Election intensify.

The INEC Chairman, Professor Joash Amupitan, SAN, disclosed this on Thursday 5th February, 2026 in Abuja at the Commission’s first regular consultative meeting with leaders of political parties in 2026, describing the year as a critical phase of heightened electoral activities that would test the preparedness and commitment of all stakeholders.

Speaking on political party registration, Prof. Amupitan said the Commission received 171 letters of intent from associations seeking registration as political parties. He explained that the applications were assessed strictly in line with Sections 222 and 223 of the Constitution of the Federal Republic of Nigeria, 1999 (as amended), relevant provisions of the Electoral Act, 2022, and the Commission’s Regulations and Guidelines for Political Parties.

According to him, only 14 associations scaled the initial prequalification stage, while eight successfully uploaded their documents on the Commission’s dedicated portal. Following final assessment and verification of compliance with constitutional and statutory requirements, the Chairman said only the Democratic Leadership Alliance (DLA) met all conditions and was consequently registered as a political party with effect from 5th February 2026.

He further disclosed that INEC would comply with the judgment of the Federal High Court sitting in Lokoja, Kogi State, which ordered the registration of the Nigeria Democratic Congress (NDC) as a political party. With the registration of the two parties, Prof. Amupitan noted that Nigeria now has 21 registered political parties, adding that certificates of registration would be presented to the new parties in due course.

The INEC Chairman expressed deep concern over the increasing incidence of leadership disputes within political parties, describing the trend as unhealthy for Nigeria’s democracy and a distraction to the Commission’s core mandate. He noted that frequent litigations arising from internal party crises often result in INEC being joined as a party, thereby diverting time and resources from election management.

According to him, such disputes create uncertainty among party members and supporters, erode public confidence in the political system and undermine democratic stability. While reaffirming INEC’s neutrality, Prof. Amupitan urged party leaders to prioritise internal democracy, transparent leadership and constructive dialogue, stressing that cohesive party structures are indispensable to credible elections.

On ongoing and forthcoming electoral activities, the Chairman recalled that shortly after assuming office, the Commission successfully conducted the Anambra State off-cycle governorship election in November 2025, which he said was widely acknowledged as credible, peaceful and transparent.

He said INEC is currently focused on the conduct of the Federal Capital Territory (FCT) Area Council elections scheduled for Saturday, 21st February 2026, noting that over 1.68 million registered voters are expected to vote across 2,822 polling units in the six Area Councils. He added that non-sensitive materials had been delivered, training of Electoral Officers, Assistants and election security personnel concluded, while BVAS devices were being configured ahead of the polls.

Prof. Amupitan also disclosed that bye-elections would hold the same day in Rivers State for the Ahoada East II and Khana II State Constituencies, as well as in Kano State for the Kano Municipal and Ungogo State Constituencies, following vacancies occasioned by resignation and the death of lawmakers.

Looking ahead, the INEC Chairman confirmed that the Ekiti State governorship election would hold on 20th June 2026, while the Osun State governorship election is scheduled for 8th August 2026, noting that activities in the respective timetables were progressing as scheduled.

On the 2027 General Election, Prof. Amupitan said the Commission had finalised the Timetable and Schedule of Activities in compliance with the Constitution and the Electoral Act, 2022, but was awaiting the conclusion of ongoing amendments to the Electoral Act by the National Assembly. He urged stakeholders to encourage the legislature to expedite the process to ensure a stable legal framework well ahead of the elections.

The Chairman also announced that INEC would soon embark on a nationwide Voter Revalidation Exercise ahead of 2027, explaining that despite regular updates since 2011, the current voters’ register still contains anomalies such as duplicate registrations, inclusion of deceased persons and inaccurate records, which undermine public confidence.

He described a credible voters’ register as the bedrock of free, fair and transparent elections and said sanitising the register was essential to strengthening the integrity of the electoral process.

Prof. Amupitan further lamented the steady decline in voter turnout over successive elections, citing presidential election figures that dropped from 53.7 per cent in 2011 to 26.7 per cent in 2023. While noting that technologies such as BVAS have eliminated ballot stuffing and ghost voting, he stressed that voter apathy cannot be addressed by technology alone.

He called on political parties to intensify voter education and mobilisation efforts, noting that rebuilding public trust and inspiring citizens to participate in the electoral process is a shared responsibility.

On the ongoing Continuous Voter Registration (CVR) exercise, the INEC Chairman disclosed that 2,782,587 eligible voters were registered during the first phase conducted between August and December 2025, while the second phase, which commenced in January 2026, will run until April 2026. He warned that multiple registration is a violation of the law and assured that INEC’s technology would detect and remove offenders from the voters’ register.

Responding, the National Chairman of the Inter-Party Advisory Council (IPAC), Dr. Yusuf Mamman Dantalle, congratulated Prof. Amupitan on his appointment and described the consultative meeting as timely, given the scale of electoral activities leading to the 2027 General Election.

Dr. Dantalle reaffirmed IPAC’s expectation that INEC would continue to act independently, neutrally and decisively, while providing a level playing field for all political parties and candidates.

He acknowledged the prevalence of leadership disputes within some political parties and urged INEC to be guided strictly by the constitutions of the respective parties when recognising and publishing party leadership on its website, noting that such recognition confers legitimacy and determines the official leadership with which the Commission engages.

According to him, strict adherence to party constitutions would reduce litigations, dispel perceptions of bias or interference and strengthen internal party democracy. He also urged political parties to utilise IPAC’s internal alternative dispute resolution mechanisms rather than resorting prematurely to the courts.

The IPAC Chairman further called on the National Assembly to expedite the harmonisation of the electoral legal framework, stressing that time was of the essence as the country moves closer to the 2027 General Election.

Former Commissioner of the Independent National Electoral Commission, INEC, Dr Mustapha Lecky, says Nigeria is not technically ready for real-time electronic transmission of election results.

Former Commissioner of the Independent National Electoral Commission, INEC, Dr Mustapha Lecky, says Nigeria is not technically ready for real-time electronic transmission of election results.

A Professor of Communications at Baze University, Abiodun Adeniyi, has suggested why Nigeria’s elections are always shrouded in dispute.

A Professor of Communications at Baze University, Abiodun Adeniyi, has suggested why Nigeria’s elections are always shrouded in dispute.

The lawmaker representing Isuikwuato constituency in the Abia State House of Assembly, Lucky Udoka Nweke Johnson, has expressed sadness following the killing of a 35-year-old man, Uche Simon by unknown gunmen.

The lawmaker representing Isuikwuato constituency in the Abia State House of Assembly, Lucky Udoka Nweke Johnson, has expressed sadness following the killing of a 35-year-old man, Uche Simon by unknown gunmen.

The North East Development Commission, NEDC, has expressed deep sympathy to the Nigeria Union of Journalists,NUJ, Bauchi State Chapter, and the Bauchi State Government over a tragic road accident that occurred on the Bauchi–Alkaleri road on Friday, February 6, 2026.

The North East Development Commission, NEDC, has expressed deep sympathy to the Nigeria Union of Journalists,NUJ, Bauchi State Chapter, and the Bauchi State Government over a tragic road accident that occurred on the Bauchi–Alkaleri road on Friday, February 6, 2026.

The passage of the electoral act amendment bill by the senate on Thursday has drawn sharp criticism from experts, who say the rejection of real-time transmission of election results risks eroding public confidence in Nigeria’s elections.

The passage of the electoral act amendment bill by the senate on Thursday has drawn sharp criticism from experts, who say the rejection of real-time transmission of election results risks eroding public confidence in Nigeria’s elections.

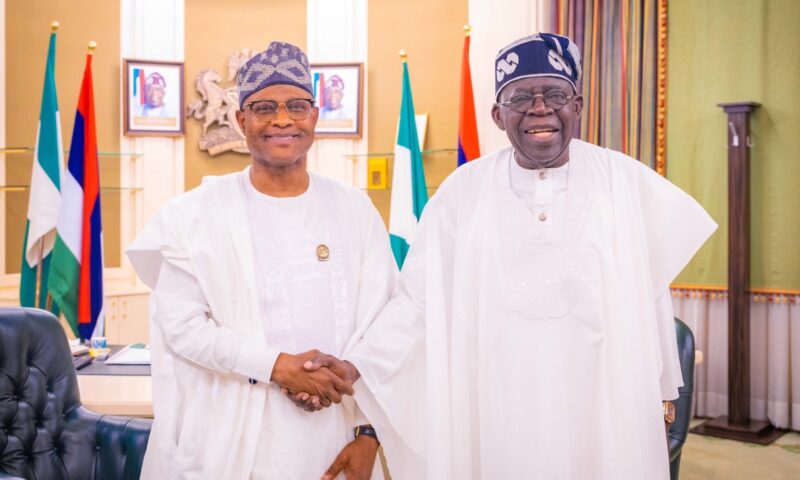

President Bola Ahmed Tinubu on Friday received the Governor of Kaduna State, Senator Uba Sani, at the Presidential Villa, Abuja.

President Bola Ahmed Tinubu on Friday received the Governor of Kaduna State, Senator Uba Sani, at the Presidential Villa, Abuja.

The Lagos State Electricity Regulatory Commission has begun a process of understudying the Nigerian Electricity Regulatory Commission as part of efforts to strengthen electricity market regulation in the state.

The Lagos State Electricity Regulatory Commission has begun a process of understudying the Nigerian Electricity Regulatory Commission as part of efforts to strengthen electricity market regulation in the state.

Ecobank Transnational Incorporated has reported a 29 per cent rise in profit after tax to N950.0bn for the financial year ended December 31, 2025, driven by growth in interest income and non-interest revenue.

Ecobank Transnational Incorporated has reported a 29 per cent rise in profit after tax to N950.0bn for the financial year ended December 31, 2025, driven by growth in interest income and non-interest revenue.

The Chartered Institute of Bankers of Nigeria has commended Abia State Governor, Alex Otti, for the notable economic progress recorded in the state under his leadership.

The Chartered Institute of Bankers of Nigeria has commended Abia State Governor, Alex Otti, for the notable economic progress recorded in the state under his leadership.