United Bank for Africa has partnered with Renewvia Solar Nigeria to deploy solar solutions across 25 UBA branches in five Nigerian states.

United Bank for Africa has partnered with Renewvia Solar Nigeria to deploy solar solutions across 25 UBA branches in five Nigerian states.

According to a statement from the lender on Wednesday, the move strengthened economic ties between Nigeria and Norway.

The partnership was formalised at the ribbon-cutting ceremony held at the UBA Oba Akran 2 branch, Ikeja-Lagos, Nigeria, which was attended by the Nordic Ambassador to Nigeria, Mr. Svein Bæra, following an inspection of the Inverter/Battery room and operations by the Renewvia team.

This initiative reflects a growing commitment to sustainable investment and innovation, a key message emphasised by UBA Group Chairman, Tony Elumelu, during the recent Norway–Africa Business Summit held in Oslo, where he urged global partners to view Africa not as an aid destination, but as a continent of opportunity and enterprise.

The partnership between UBA and Renewvia embodies that call, channelling Nordic investment and African innovation into tangible, long-term impact. Supported by Empower New Energy, a leading Norway-based renewable investment company, and Incremental Energy Solution, the project will deliver the first phase of 152,000 kWh of clean energy monthly, reducing UBA’s carbon footprint by over 89,000 kilograms of CO₂ each month.

Under a 10-year Power-as-a-Service agreement, Renewvia will deploy advanced solar and battery hybrid systems across UBA’s branches, ensuring superior power reliability, operational efficiency, and an enhanced customer experience. Upon full rollout, the project will cover 50 locations across 18 states, representing 3 MWp of solar capacity and 7 MWh of energy storage.

On the partnership, UBA’s Deputy Managing Director, Muyiwa Akinyemi, said, “At UBA, we believe sustainability is not just a responsibility but a key part of building Africa’s future. This project demonstrates how innovation and partnership can deliver lasting impact in terms of growth and advancement, as well as reducing our carbon footprint, improving operational efficiency, and contributing to a cleaner environment. We are proud to work with Renewvia Solar Nigeria, Incremental Energy Solutions, and Empower New Energy to make this vision a reality.”

Earlier, in his goodwill message, the Norwegian Ambassador to Nigeria, Svein Bæra, noted that the partnership is a shining example of what can be achieved when African ambition meets Nordic investment and innovative practices. “It also represents not just an energy milestone but a strong statement of shared commitment to sustainable growth and climate responsibility,” he said.

On his part, the Managing Director of Renewvia Solar Nigeria Limited, Adebowale Dosunmu, said, “This partnership with UBA marks a major milestone in our mission to deliver reliable, clean energy to commercial and industrial clients across Nigeria. We are proud to support UBA’s leadership in sustainability and operational excellence.

The CEO of Incremental Energy Solutions Ltd, Oladipupo Omodara, who also spoke on the project, said, “We appreciate the cooperation and proactiveness of the UBA management team, whose support helped bring this remarkable project and partnership to life. We at IES are particularly pleased that this success reinforces our commitment to helping Africa claim its rightful place in global energy investment and technology deployment.”

Giving his remarks, CEO of Empower New Energy, Terje Osmundsen, stated that Empower New Energy is proud to be the financing partner for a landmark project with Renewvia Solar Nigeria, supporting UBA’s commitment to cleaner and more reliable energy.

“This partnership reflects our mission to enable African businesses to access sustainable power through innovative financing. It also demonstrates the strength of Nordic-African cooperation in accelerating the transition to renewable energy,” Osmundsen explained.

The bank explained that the promo targets a broad demographic, including NYSC members, women, children, and small traders, with participation starting from deposits as low as N2,000.

The bank explained that the promo targets a broad demographic, including NYSC members, women, children, and small traders, with participation starting from deposits as low as N2,000.

The President of the Dangote Group, Alhaji Aliko Dangote, has said the Nigerian National Petroleum Company Limited has the opportunity to increase its 7.2 per cent stake in the Dangote refinery.

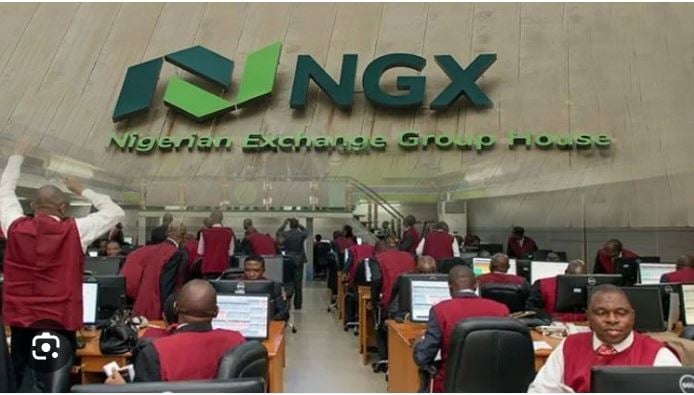

The President of the Dangote Group, Alhaji Aliko Dangote, has said the Nigerian National Petroleum Company Limited has the opportunity to increase its 7.2 per cent stake in the Dangote refinery. Total transactions in the nation’s equity market rose significantly by 78.5 per cent to N1.62tn in September 2025, up from N908.38bn recorded in August 2025, according to the latest Domestic and Foreign Portfolio Participation in Equity Trading report released by the Nigerian Exchange Limited on Thursday.

Total transactions in the nation’s equity market rose significantly by 78.5 per cent to N1.62tn in September 2025, up from N908.38bn recorded in August 2025, according to the latest Domestic and Foreign Portfolio Participation in Equity Trading report released by the Nigerian Exchange Limited on Thursday.

The National Insurance Commission, the Federal Road Safety Corps and the National Health Insurance Authority have entered into agreements to enforce motor insurance and others under the new Nigerian Insurance Industry Reform Act 2025.

The National Insurance Commission, the Federal Road Safety Corps and the National Health Insurance Authority have entered into agreements to enforce motor insurance and others under the new Nigerian Insurance Industry Reform Act 2025.

Nigeria’s equities market sustained its upward trajectory on Thursday, recording a gain of N479bn in market capitalisation as investors continued to respond positively to ongoing economic reforms and improving macroeconomic indicators.

Nigeria’s equities market sustained its upward trajectory on Thursday, recording a gain of N479bn in market capitalisation as investors continued to respond positively to ongoing economic reforms and improving macroeconomic indicators.

Savannah Energy Plc, a British independent energy company focused on the delivery of critical energy projects, has reported a total revenue of US$185.2m for the nine months ended September 30, 2025, representing a nine per cent increase from the US$169.3m recorded in the corresponding period of 2024.

Savannah Energy Plc, a British independent energy company focused on the delivery of critical energy projects, has reported a total revenue of US$185.2m for the nine months ended September 30, 2025, representing a nine per cent increase from the US$169.3m recorded in the corresponding period of 2024.

United Bank for Africa has partnered with Renewvia Solar Nigeria to deploy solar solutions across 25 UBA branches in five Nigerian states.

United Bank for Africa has partnered with Renewvia Solar Nigeria to deploy solar solutions across 25 UBA branches in five Nigerian states.

Lafarge Africa Plc has reported a 144 per cent increase in its profit after tax to N75bn for the third quarter of 2025, compared to N30.7bn recorded in the corresponding period of 2024, driven by higher sales volume.

Lafarge Africa Plc has reported a 144 per cent increase in its profit after tax to N75bn for the third quarter of 2025, compared to N30.7bn recorded in the corresponding period of 2024, driven by higher sales volume.