Seplat eyes output growth with Mobil assets takeover

Seplat Energy Plc says it is positioning to ramp up oil and gas production following the acquisition and integration of Mobil Producing Nigeria Unlimited assets, which the company described as a high-quality portfolio with significant reserves and output potential.

Seplat Energy Plc says it is positioning to ramp up oil and gas production following the acquisition and integration of Mobil Producing Nigeria Unlimited assets, which the company described as a high-quality portfolio with significant reserves and output potential.

Chief Executive Officer Roger Brown stated this during a fireside chat titled ‘Assets Acquisition Success Strategies: Seplat Energy’ at the recent Africa Energy Week in South Africa.

According to a release, Brown said the acquisition had strengthened Seplat’s operations by combining its onshore experience with decades of offshore expertise from the new team, resulting in improved performance and higher cash flow from day one.

“The recent reserves upgrade shows we have acquired a high-quality asset with significant production potential in both oil and gas, and much of this is within easy reach, close to export infrastructure that we control. We are confident we can increase production, and that aligns with the government’s target to increase liquids production to three million barrels per day and to increase gas production for both domestic energy and export markets,“ he said.

Brown noted that the company’s focus after the acquisition had been to quickly re-engage wells and facilities to deliver immediate results, invest early in asset reliability to reduce downtime, and integrate both systems and people.

“We found strong cultural alignment with our new colleagues, and that’s been key to seamless performance. We’ve welcomed their expertise and insights, and the entire group is benefiting from them,” Brown stated.

He added that Seplat’s growth strategy had been built on acquiring assets where its operating capability could unlock hidden value, particularly mature fields that required a more agile operator.

“We’ve already proven we can acquire assets onshore and bring them up to high levels of production while keeping tight control of costs,” he said.

The Seplat boss emphasised that maintaining safety, operational excellence, and a disciplined cost structure remained central to the company’s performance.

Describing the company as a low-cost operator, he said, “We can be profitable at good oil prices, and we’ve proven we can survive periods of low prices and prolonged lock-ins.”

On financing, Seplat’s Chief Financial Officer, Eleanor Adaralegbe, said the company had raised over $4bn in debt to develop operations while maintaining a leverage ratio below 1.5 times through the cycle.

She explained that Seplat had relied on a mix of financing instruments, including its Initial Public Offer, Revolving Credit Facility, Bonds, Advance Payment Facility, and project financing, notably the $320m facility for ANOH Gas Processing Company, its joint venture with the Nigerian Gas Infrastructure Company.

“We knew that we had to become a first mover and shape our credit profile to appeal to a wider group of banks and investors. We are the first and only dual-listed Nigerian oil and gas company,” she said.

Adaralegbe added that Seplat had consistently refinanced its obligations to extend maturities and lower borrowing costs, supported by asset diversification, steady production, and strong financial governance.

The Securities and Exchange Commission has announced plans to transition Nigeria’s capital market from a T+3 to a T+2 settlement cycle to enhance market efficiency, reduce risks, and strengthen investor confidence.

The Securities and Exchange Commission has announced plans to transition Nigeria’s capital market from a T+3 to a T+2 settlement cycle to enhance market efficiency, reduce risks, and strengthen investor confidence.

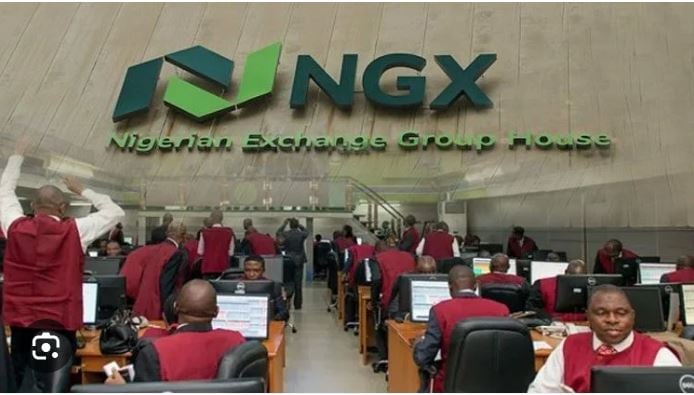

The Nigerian Exchange Limited on Wednesday extended its gaining streak as the equities market added N20bn in value, bringing the total market capitalisation to N93.8tn at the close of trading.

The Nigerian Exchange Limited on Wednesday extended its gaining streak as the equities market added N20bn in value, bringing the total market capitalisation to N93.8tn at the close of trading.

The Dangote Petroleum refinery has reportedly earned a commendation from the global board members of the Project Management Institute, which described the facility as a world-class model of excellence in project execution.

The Dangote Petroleum refinery has reportedly earned a commendation from the global board members of the Project Management Institute, which described the facility as a world-class model of excellence in project execution.

The Nigerian Electricity Regulatory Commission has approved the disbursement of N28bn to electricity distribution companies for the second phase of the Meter Acquisition Fund scheme, for the metering of all outstanding Band A customers free of charge.

The Nigerian Electricity Regulatory Commission has approved the disbursement of N28bn to electricity distribution companies for the second phase of the Meter Acquisition Fund scheme, for the metering of all outstanding Band A customers free of charge.

The Manufacturers Association of Nigeria (MAN) has reiterate its call for the Federal Government to designate an annual “Proudly Nigeria Day.”

The Manufacturers Association of Nigeria (MAN) has reiterate its call for the Federal Government to designate an annual “Proudly Nigeria Day.”

The Nigerian Exchange Limited opened the week on a positive note, gaining N465bn in market capitalisation on Monday as investors increased their interest in insurance and industrial stocks.

The Nigerian Exchange Limited opened the week on a positive note, gaining N465bn in market capitalisation on Monday as investors increased their interest in insurance and industrial stocks.

Nigeria’s crude oil production shrank to 1.39 million barrels per day in September 2025, marking the second consecutive month of reduced output.

Nigeria’s crude oil production shrank to 1.39 million barrels per day in September 2025, marking the second consecutive month of reduced output.