The Chartered Institute of Bankers of Nigeria has commended Abia State Governor, Alex Otti, for the notable economic progress recorded in the state under his leadership.

The Chartered Institute of Bankers of Nigeria has commended Abia State Governor, Alex Otti, for the notable economic progress recorded in the state under his leadership.

The President and Chairman of the Council of the CIBN, Prof. Pius Olarenwaju, made this known on Thursday when he led members of the institute on a courtesy visit to the governor at his office.

He noted that the state had recorded significant economic milestones, including a 10 per cent increase in Gross Domestic Product, an eight per cent reduction in poverty, the attraction of investments and the creation of over 10,000 jobs.

“You have achieved, within this short time, notable economic progress, including a 10 per cent GDP increase, an eight per cent poverty reduction in this part of the country, the attraction of significant investments and the creation of over 10,000 jobs

“We have heard about it in the newspapers, but it is more glorious for us to see it firsthand and go back to tell more people. So, we appreciate you, sir,” he stated.

Olarenwaju also lauded improvements in the social sector, including strengthened healthcare delivery, reduced mortality rates, the introduction of health insurance and enhanced education infrastructure through free education policies.

He further acknowledged improvements in road infrastructure and other ongoing projects, which he described as evidence of purposeful governance.

He commended the state’s Operation Crush initiative, noting that it had improved security, boosted youth confidence and enhanced economic activities across Abia.

The CIBN chairman also saluted Otti’s contributions to the banking and finance profession and informed him of plans by the institute to organise an event later in the year to honour outstanding former bank chief executives for their impact on the industry.

Describing Otti as a goodwill ambassador of the institute, Olarenwaju said the governor’s achievements had become a source of pride to CIBN members.

He added that Otti continued to represent the institute well, having made a mark in the banking industry and now excelling in public service.

Olarenwaju called for deeper collaboration between the CIBN and the Abia State Government in areas such as financial literacy, financial inclusion, completion of the CIBN state office and infrastructural development, among others.

He disclosed that the institute was involved in a national programme aimed at training 10 million women and youths on financial inclusion, describing financial literacy as fundamental to economic empowerment.

“We want the involvement of the state in this programme. I mentioned earlier that there is a condition precedent to financial inclusion, and that is financial literacy.

“We are intentional about this, and we will go ahead to do this,” he stated.

Receiving the delegation, Otti reaffirmed his commitment to sustainable development and stronger collaboration with the CIBN.

He said he was keen on deepening the partnership with the institute, adding that the relationship was already well established.

The governor highlighted some key achievements of his administration, including job creation, economic growth, poverty reduction, the introduction of free and compulsory education, and improved healthcare delivery.

He disclosed that the free education policy had resulted in over a 100 per cent increase in school enrolment, adding that his administration had recruited 5,394 teachers, with the process of employing an additional 4,000 currently ongoing.

Otti, who commended the CIBN’s efforts in curriculum reform, expressed interest in adopting its updated curriculum across state-owned tertiary institutions and appreciated its proposals for regional conferences, financial literacy programmes and broader collaboration.

“The institute’s programme on financial inclusion and financial literacy for members of the public is very important.

“You find that even for those of us who claim to have some knowledge, we still make mistakes in investment—not deliberately, but because we do not know. So, I am very happy that you are doing this,” Otti stated.

The governor was joined by the Commissioner for Finance, Hon. Uwaoma; the Commissioner for Agriculture, Hon. Cliff Agbaeze; the Accountant-General of the State, Mrs Njum Uma-Onyemenam, FCA; and other senior government officials

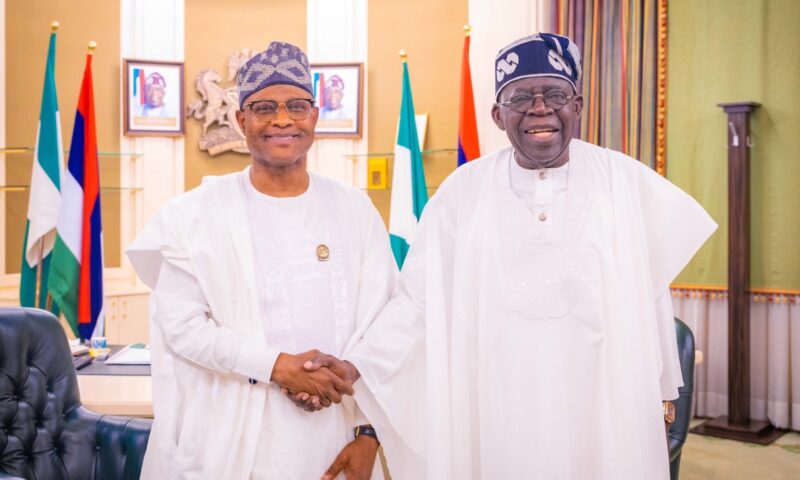

President Bola Ahmed Tinubu on Friday received the Governor of Kaduna State, Senator Uba Sani, at the Presidential Villa, Abuja.

President Bola Ahmed Tinubu on Friday received the Governor of Kaduna State, Senator Uba Sani, at the Presidential Villa, Abuja.

Ecobank Transnational Incorporated has reported a 29 per cent rise in profit after tax to N950.0bn for the financial year ended December 31, 2025, driven by growth in interest income and non-interest revenue.

Ecobank Transnational Incorporated has reported a 29 per cent rise in profit after tax to N950.0bn for the financial year ended December 31, 2025, driven by growth in interest income and non-interest revenue.

The Chartered Institute of Bankers of Nigeria has commended Abia State Governor, Alex Otti, for the notable economic progress recorded in the state under his leadership.

The Chartered Institute of Bankers of Nigeria has commended Abia State Governor, Alex Otti, for the notable economic progress recorded in the state under his leadership.

Policy and Legal Advocacy Centre, PLAC, has asked the Senate not to act as overlords but respect citizens’ views in the ongoing review of the Electoral Act.

Policy and Legal Advocacy Centre, PLAC, has asked the Senate not to act as overlords but respect citizens’ views in the ongoing review of the Electoral Act.

Nestlé Nigeria Plc has been awarded the highest level of Authorised Economic Operator certification by the Nigeria Customs Service. The company received security and safety status under the programme, which is valid for five years and recognises compliance with trade regulations and supply chain security standards.

Nestlé Nigeria Plc has been awarded the highest level of Authorised Economic Operator certification by the Nigeria Customs Service. The company received security and safety status under the programme, which is valid for five years and recognises compliance with trade regulations and supply chain security standards.

Dangote Petroleum Refinery has warned that continued reliance on coastal delivery of petroleum products could push petrol prices close to N1,000 per litre in Nigeria.

Dangote Petroleum Refinery has warned that continued reliance on coastal delivery of petroleum products could push petrol prices close to N1,000 per litre in Nigeria.

Savannah Energy Plc, has released its financial and operational update on its Nigerian operations and other markets in Africa, including up-to-date cash collections in its Nigerian business.

Savannah Energy Plc, has released its financial and operational update on its Nigerian operations and other markets in Africa, including up-to-date cash collections in its Nigerian business.

The Nigerian National Petroleum Company Limited (NNPCL) has opened talks with a Chinese company over one of the state-owned oil firm’s refineries.

The Nigerian National Petroleum Company Limited (NNPCL) has opened talks with a Chinese company over one of the state-owned oil firm’s refineries.

Dangote Petroleum Refinery & Petrochemicals (DPRP) has dismissed reports suggesting that it imports finished petroleum products.

Dangote Petroleum Refinery & Petrochemicals (DPRP) has dismissed reports suggesting that it imports finished petroleum products.

The Securities and Exchange Commission (SEC, Nigerian Exchange Group Plc (NGX Group) and the Police have agreed to achieve Capital Market integrity, affirming collaboration to ensure sustainable operations.

The Securities and Exchange Commission (SEC, Nigerian Exchange Group Plc (NGX Group) and the Police have agreed to achieve Capital Market integrity, affirming collaboration to ensure sustainable operations.